Exploring the Team Forex platform – dashboards, tools, and risk settings explained.

For groups managing capital, a system’s capacity for granular permission structures is non-negotiable. Seek a solution that allows you to define user roles with surgical precision: view-only access for observers, trade execution rights for operators, and full configuration authority for strategists. The absence of this hierarchy invites operational chaos.

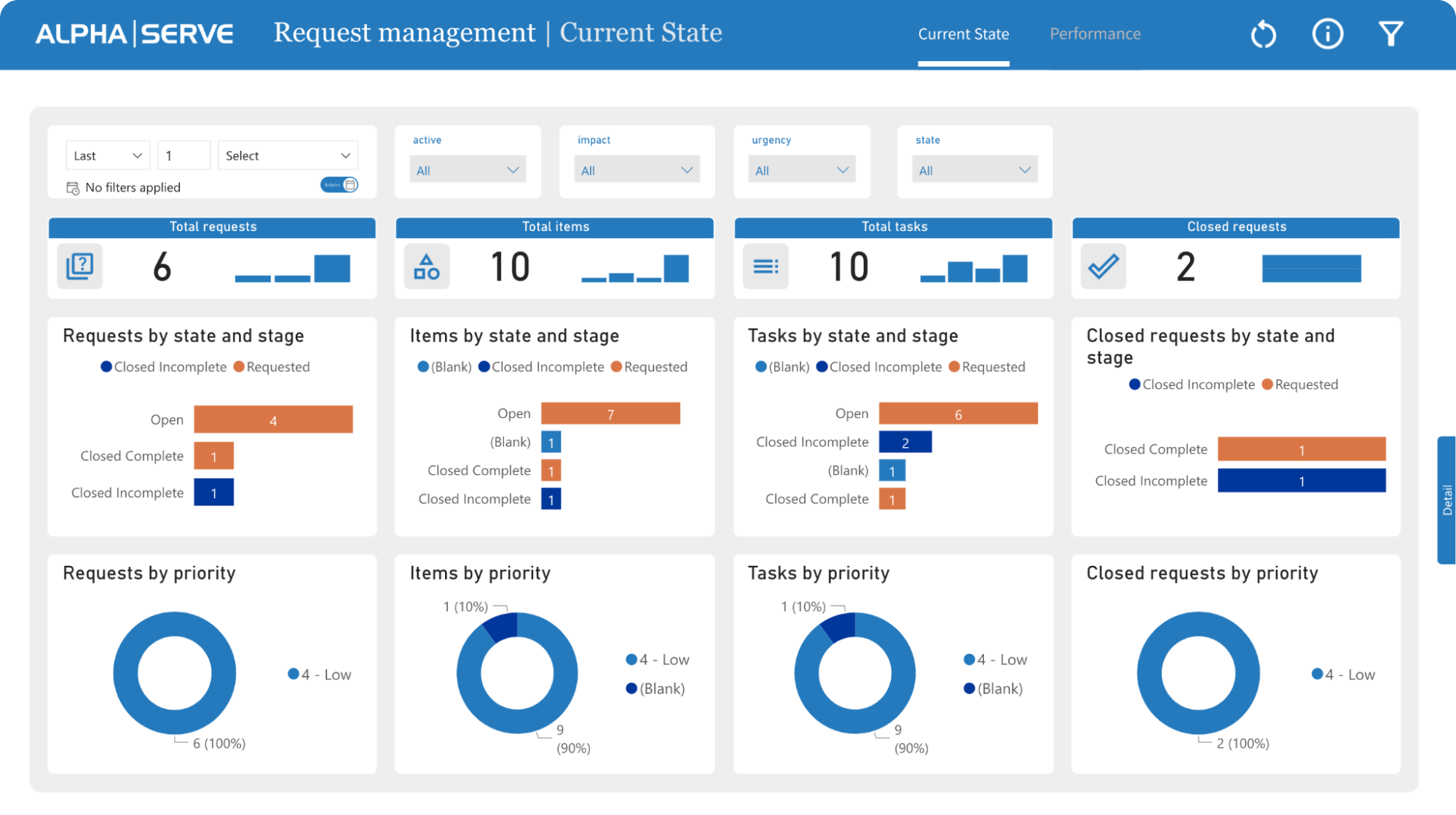

Real-time collective oversight demands a consolidated visual interface. Your primary screen should aggregate all active positions, margin usage across accounts, and pending orders from every connected terminal. This single-pane view transforms data into immediate awareness, preventing exposure from being obscured across multiple windows.

Instrument-specific constraints form the bedrock of sustainable strategy. Configure maximum allowable lot sizes, daily loss limits per analyst, and automatic drawdown triggers at the strategy level, not just the account level. This enforces discipline programmatically, removing emotion from the equation. For instance, setting a global 0.5% maximum per trade cap protects the pool from any single miscalculation.

Beyond basic charts, the utility of embedded analytical resources is critical. Assess the availability of custom script libraries for backtesting, shared economic calendars with collaborative annotation, and performance attribution analytics that break down returns by individual trader and instrument. These features shift the focus from simple execution to measurable, iterative improvement.

Finally, audit integrity is paramount. A robust log must chronicle every action–login attempts, order modifications, parameter adjustments–with user tags and timestamps. This immutable record provides clarity for post-trade analysis and is indispensable for reconciling decisions with outcomes. Without it, diagnosing the source of a loss or a rule breach becomes speculative.

Team Forex Platform: Review Dashboards, Tools, and Risk Settings

Consolidate all exposure metrics onto a single glass pane. Your primary screen must display aggregate equity, margin usage across all active positions, and real-time P&L for each member. This eliminates blind spots.

Analytical Instruments & Collective Oversight

Implement co-charting with shared drawing tools; annotations made by one analyst should be visible instantly to all. Configure conditional alerts for specific currency pair levels, sent simultaneously to the group’s communication channel, not just individual terminals. Use correlation matrices to visually flag when multiple members’ trades are inadvertently concentrated on a single macroeconomic hypothesis.

Mandate the use of a centralized economic calendar integrated with pending order flows. Flag days where high-impact news events coincide with clustered stop-loss levels from the group’s open trades.

Configuring Collective Safeguards

Define maximum drawdown limits at two tiers: per individual trader (e.g., 5% of their allocated capital) and for the entire syndicate (e.g., 15% of pooled funds). These caps must be hard-coded, triggering automatic trade disablement. Set position size algorithms based on a percentage of current portfolio volatility, not just account balance. This dynamically adjusts leverage during unstable market conditions.

Establish a protocol for “circuit breakers.” If daily loss thresholds are met, the system should freeze new trade initiation while allowing the management of existing positions. All parameter changes require two-factor authentication from designated supervisors.

How to Set Up a Multi-Account Dashboard for Tracking All Team Trades

Select a specialized aggregation service like MetaTrader 5 Manager, Myfxbook AutoTrade, or proprietary software from your brokerage. These systems connect directly to your group’s individual MetaTrader 4/5 or cTrader terminals via API keys, pulling execution data without requiring manual input.

Architecture and Data Flow

Configure a master account to act as the data hub. Each trader’s terminal must grant explicit read-only API access. This setup streams live positions, entry prices, lot sizes, and current P&L from every connected terminal into a single visual interface. Establish a dedicated VPS to host the aggregation software, ensuring 24/7 uptime and consistent data synchronization.

Define custom columns for your consolidated view: Account ID, Symbol, Volume, Entry Time, Drawdown %, and Daily P/L. Set filters to view activity by individual, currency pair, or strategy tag. Enable alerts for aggregated exposure exceeding a predefined capital allocation–for instance, a total position size of 5 standard lots across all accounts on EUR/USD.

Automating Oversight and Reporting

Implement automated daily reports sent via email or Slack. These should detail gross exposure, net P&L, and commission totals. Use the dashboard’s graphing tools to chart cumulative equity curves against key benchmarks. Schedule weekly reconciliation to verify the aggregated data matches individual broker statements, catching any synchronization errors.

Restrict dashboard modification rights to managers. Grant traders view-only access to the collective activity, fostering transparency while maintaining control. Regularly audit API key validity and update the aggregation software to maintain secure, uninterrupted data flow from all linked terminals.

Configuring Trade Copier and Allocation Tools for a Funded Account

Set the allocation method to ‘Balance-based’ rather than ‘Fixed Lot’ to automatically adjust position sizes proportionally across accounts with different capital levels. This maintains consistent equity risk per trade regardless of individual account size.

Critical Synchronization Parameters

Configure these parameters in your trade replication software to prevent execution failures:

- Latency Tolerance: Set a maximum delay of 100-150ms between signal and execution. Higher values increase slippage risk.

- Order Retry: Enable with 2-3 attempts and a 500ms interval for broker requotes.

- Symbol Mapping: Manually verify and map master account symbols (e.g., XAUUSD) to any different symbols (GOLD) on follower terminals.

Utilize the Team Forex platform to manage these configurations centrally. Its interface allows for bulk application of settings to multiple funded accounts, streamlining the initial setup.

Protection Rules for Capital Safety

Implement hard stops within the copier, independent of the strategy. Define these rules:

- Daily Loss Limit: Halt copying if an account’s daily drawdown reaches 2% of its starting balance.

- Global Maximum Drawdown: Stop all activity if total equity falls 6% from its highest point.

- Weekly Profit Cap: Pause new trades for the week upon reaching a 5% gain to lock in profits.

Test the entire configuration in a demo environment for a minimum of one week. Monitor the ‘Trades’ log specifically for mismatched entries, partial fills, or latency errors before going live with investor capital.

Adjusting Platform-Level Drawdown and Leverage Limits for Team Members

Set maximum daily drawdown at 5% and equity drawdown at 15% per individual account to prevent catastrophic losses. Apply leverage caps based on experience: 1:10 for novices, 1:25 for intermediate, and a maximum of 1:50 for seasoned analysts. These ceilings must be enforced directly within the software’s administrative panel.

Configuring Hard and Soft Boundaries

A hard drawdown limit should trigger an automatic position closure. Implement a soft alert at 70% of this threshold, notifying both the trader and supervisor. For leverage, use tiered margin requirements. Higher leverage access should mandate a larger minimum account balance, creating a natural financial buffer.

| Apprentice | 1:10 | 2% | 7% |

| Strategist | 1:25 | 3.5% | 12% |

| Lead Analyst | 1:50 | 5% | 15% |

Schedule a quarterly review of these parameters. Adjust limits only after analyzing three months of individual performance metrics, including risk-adjusted return and Sharpe ratio. Never increase both leverage and drawdown limits simultaneously.

Operational Protocols for Enforcement

All modifications must require a two-factor approval from senior management within the system, creating an audit trail. Link these restrictions directly to the login credentials; they cannot be overridden by the user. Integrate these controls with real-time monitoring feeds to allow for exceptional, manual intervention during periods of extreme market volatility.

FAQ:

What specific risk management settings should I look for in a team Forex platform?

A robust team platform must offer granular, role-based risk controls. Key settings include individual trader drawdown limits (daily, weekly, monthly), maximum position size per instrument or per trader, and leverage caps. Look for the ability to restrict trading to certain symbol groups or specific hours. The platform should allow a master account manager to set these parameters for each sub-account and have them enforced automatically by the system, preventing any override by the trader. This structure protects the capital of the entire operation.

How does a shared dashboard improve a Forex team’s performance?

A shared dashboard gives all members, from managers to traders, a single source of truth. Instead of compiling reports manually, everyone sees real-time data on equity, open positions, and P&L across all managed accounts. This transparency helps identify successful strategies quickly and spot traders who might be struggling. Managers can make faster decisions based on aggregated data, while traders can benchmark their performance against the team’s goals, fostering accountability and aligned objectives.

Can you explain the difference between a PAMM and a copy-trading tool within a team platform?

Yes. A PAMM (Percentage Allocation Management Module) is a proportional allocation system. Investors’ funds are pooled, and trades from the master account are replicated across all investor accounts based on their share of the total pool. Profits and losses are distributed as a percentage. Copy-trading, often called mirror-trading, is a one-to-one replication. Each investor’s account copies the master’s trades identically, using their own lot size based on their balance and risk settings. PAMM is typically more suited for fund-style management where the manager controls the capital allocation, while copy-trading offers more individual flexibility for investors to choose which strategies to follow and adjust their own risk.

Are there platforms that allow both manual and algorithmic traders to work in the same team structure?

Several advanced platforms support hybrid teams. These systems provide a unified dashboard where managers can oversee both human traders and automated Expert Advisors (EAs). The platform should allow risk settings to be applied equally to manual and algorithmic activity, such as setting maximum daily loss limits per EA. A key feature is the ability to allocate specific capital amounts or virtual “pools” to different strategies, keeping their performance and risk separate for clear analysis. This lets a firm combine discretionary trading talent with systematic strategies under one management umbrella.

What reporting features are most useful for providing updates to investors in a managed Forex service?

Investors require clear, concise, and regular reports. The platform should generate automated reports showing key metrics: period return, overall gain/loss, volatility (like Sharpe Ratio), maximum drawdown, and a detailed trade history. Graphs showing equity growth and drawdown periods are very effective. The best platforms let you customize these reports with your firm’s branding and schedule them for automatic email delivery weekly or monthly. This professional, automated communication builds trust and reduces administrative work for the management team.

How can I use the risk settings on a team forex platform to prevent a junior trader from exceeding their daily loss limit?

Team forex platforms provide administrative tools to enforce risk controls at the user level. To prevent a junior trader from exceeding a daily loss limit, you would first define the limit within the platform’s risk management module. This is typically found under a “User Management” or “Risk Settings” section. You assign this specific limit to the junior trader’s account profile. Once set, the platform’s trading engine will automatically monitor the trader’s open and closed positions in real-time. If the cumulative loss for the day approaches the predefined threshold, the system can trigger alerts, restrict the opening of new positions, or automatically close all existing trades. This enforcement is system-driven, removing the need for manual intervention and ensuring compliance with your firm’s risk policy.

What specific data should I look for in a platform’s review dashboard to assess my team’s performance over the last quarter?

A robust review dashboard should consolidate key performance metrics for the selected date range. Focus on these core data points: First, examine the Profit & Loss statement, broken down by trader, instrument, and strategy. This shows not just overall profitability but where it originated. Second, analyze the Win Rate alongside the Average Win to Average Loss ratio. A high win rate means little if losses are significantly larger than gains. Third, review Risk-Adjusted Return metrics, like the Sharpe Ratio, to understand performance relative to volatility taken. Fourth, check Compliance Reports for any breaches of pre-set rules, such as maximum drawdown or prohibited trading hours. Finally, the dashboard should display Trade Activity statistics—number of trades, average holding time, and most traded pairs—to reveal behavioral patterns. Correlating these datasets helps identify which strategies were effective and which traders adhered to risk parameters.

Reviews

Olivia Chen

So your magic dashboard prevents human greed from clicking ‘max leverage’? Teach me.

**Female Names :**

Another dashboard. More colored boxes and flashing numbers. They all look the same after a while. You set your stops, you watch the news, and still something blows the account. Tools don’t fix greed. Tools don’t fix panic when it’s three in the morning and a trade moves against you. All these platform reviews talk about features like it’s a new car. Who cares about the stereo if the engine seizes? My settings are simple now: small lot, wide stop, and the constant expectation of being wrong. All this complexity just gives you more ways to fool yourself. The real risk setting is the one in your own head, and no dashboard can configure that. It’s just you and the chart, same as it always was. Fancy graphics don’t change the feeling when you close a loser. Just more quiet clicking in a dark room.

**Male Names List:**

So you’ve listed a bunch of tools and settings. My question is simple: after your team sets all these “perfect” risk parameters on your dashboard, what’s your plan for when the guy actually executing the trades gets greedy on a losing streak and just changes them all? Or does the platform also include a mind-reading module you forgot to mention?

James Carter

Hey, loved the breakdown of the team features. One thing I’m still turning over in my head: how would you actually structure the permission tiers for the risk settings in a real-world shop? Like, if I’m running a small fund with three traders, do I give my junior guy a hard daily drawdown limit but let my senior guy adjust his own stop-loss multiples, or does that invite chaos? Your point about the dashboard centralizing everything is huge, but I’m curious about the human element—what’s the practical workflow for the team lead without creating a micromanagement tool? Got any war stories on finding that balance?